Dive Brief:

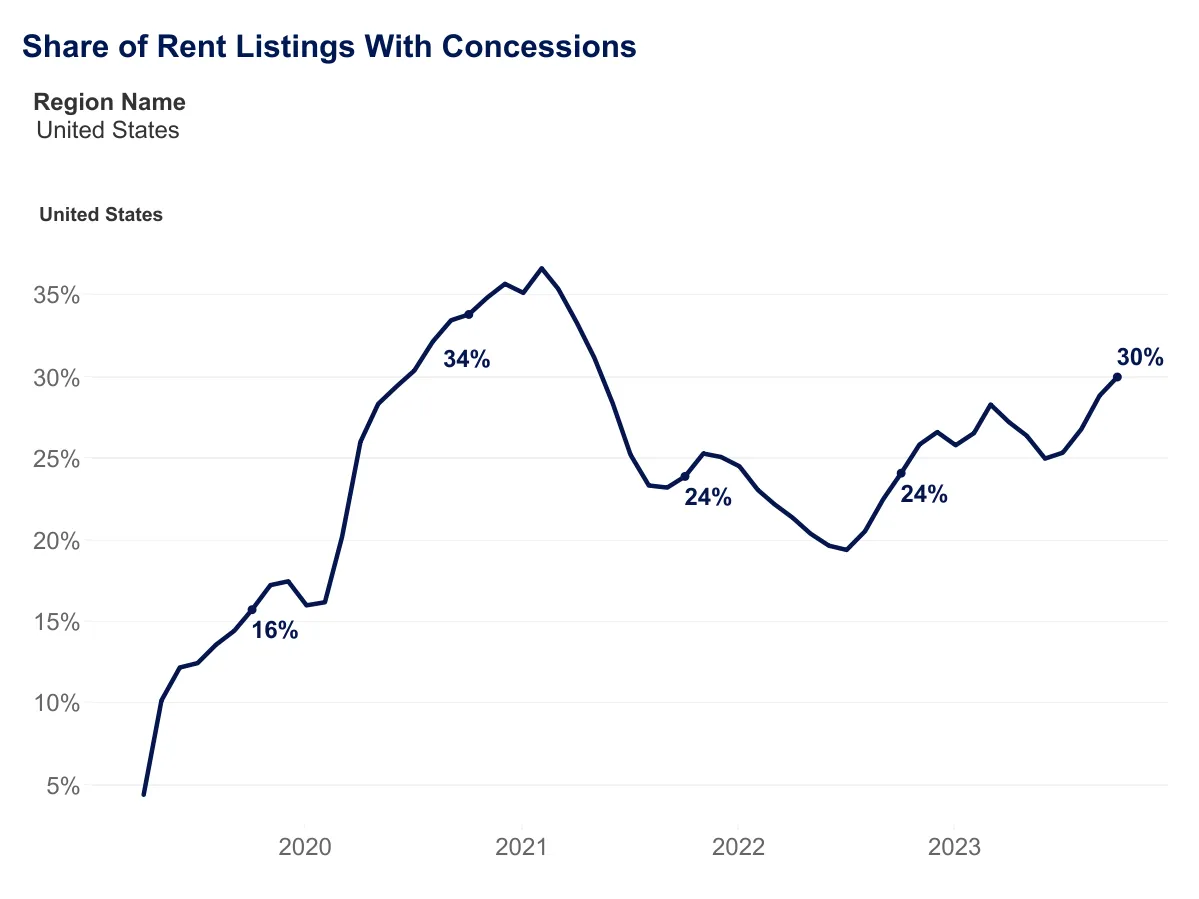

- Concessions are rising around the country, with landlords in 43 of the top 50 markets offering more discounts than last year, according to a report from Zillow.

- The metros that have the most listings with at least one concession are Salt Lake City (54% of advertisements), San Jose, California (51%) and Washington, D.C. (50%). Charlotte, North Carolina (48%) and Minneapolis (47%) are next.

- Concessions aren’t a problem in every metro, however. Only 9% of properties in New Orleans are offering giveaways. Providence, Rhode Island (14%), Miami (14%) and New York (15%) also have relatively few enticements for renters.

Dive Insight:

Salt Lake didn’t just have the highest percentage of communities offering concessions, it posted the biggest increase of properties with concessions from last year at 26 percentage points. It was followed by Charlotte (21 percentage points), Columbus, Ohio (18), Dallas (17) and Atlanta (15).

While the Zillow report did not provide information about the amount of concessions in each market, in some areas they are as high as two months or more.

Camden Property Trust CEO Ric Campo said he is seeing peak concessions of three months in markets like Nashville and Austin, Texas, where new supply is as high as 6% of inventory. In other Sun Belt markets, like Charlotte, developers are offering four to six weeks of free rent, he said on the REIT’s third quarter earnings call.

In some cities, concessions did drop over the past year. In Richmond, Virginia, they fell by five percentage points, followed by Louisville, Kentucky (-4 percentage points), Providence (-4), Sacramento, California (-2), Washington, D.C. (-1) and Hartford, Connecticut (-1).

Despite some declines in these smaller, second-tier cities, the overall trend, especially in the Sun Belt, will be for giveaways next year as new supply hits.

“Not surprisingly, all the markets that are really starting to see the highest elevated supply are the ones that we're probably seeing effective rents in the form of concessions declining,” Jay Hiemenz, president and chief operating officer of Scottsdale, Arizona-based developer Alliance Residential, told Multifamily Dive. “You look at what the hot markets were, and it's those. It's Dallas-Ft. Worth, Austin, Phoenix and Nashville.”

Many developers will be under pressure to get their properties stabilized so they can sell or potentially get permanent financing.

Spencer Gray, CEO of Indianapolis-based apartment owner and operator Gray Capital, knows of several projects offering heavy concessions in an effort to get stabilized as soon as possible.

“There are costs to carry, just from the interest payment alone, not to mention the building materials and labor,” Gray said. “They're missing their pro forma and they need to get stabilized and be taken out to permanent financing or to sell because the longer time goes on, those returns go down and the costs go up.”

Click here to sign up to receive multifamily and apartment news like this article in your inbox every weekday.