Dive Brief:

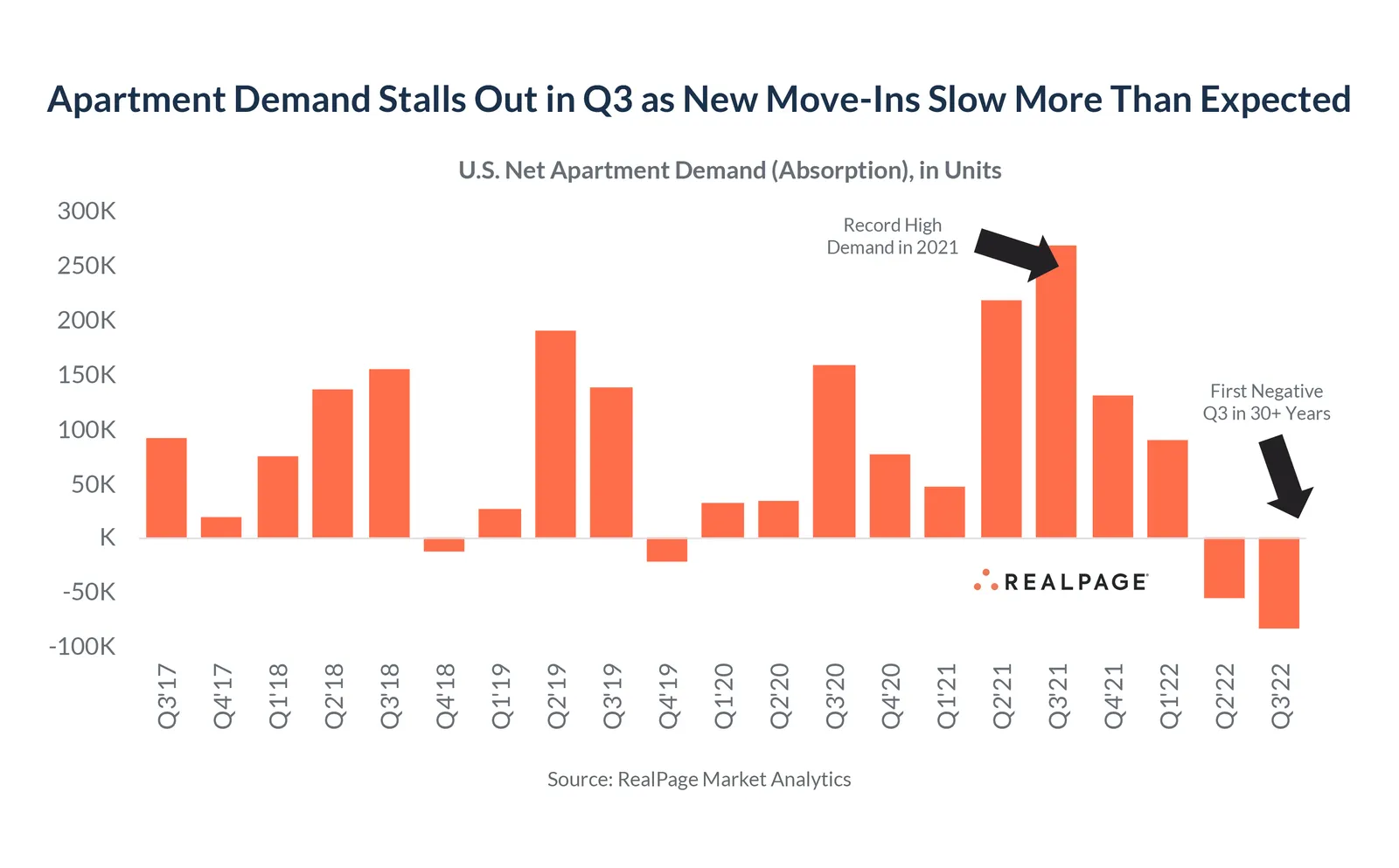

- For the first time in the 30 years that analytics firm RealPage has tracked apartments, demand has gone negative in the third quarter, which is traditionally a strong leasing period. Demand first fell in the second quarter of 2022, then dropped further in Q3 to minus 82,095 units, according to the latest market report from RealPage.

- After two negative quarters, year-to-date net apartment demand currently stands at minus 47,143 units. At the same time, effective asking rents fell month over month by 0.2% in September for the first time since December 2020. Year-over-year rent growth has also fallen to 9%, the first single-digit number since summer 2021.

- Following record-high apartment demand in 2021 and early 2022, a sharp decline in new move-ins in recent months has helped push demand to negative levels.

Dive Insight:

Jay Parsons, vice president, head of economics and industry principals for RealPage, attributes the drop in demand to the effects of inflation, rising rates and low consumer confidence.

“The rental market of 2022 looks nothing like 2021,” Parsons said in a post on LinkedIn preceding the release of the report. “The preliminary numbers for U.S. apartment demand look [way] weaker than expected.”

Parsons emphasized that the market wasn’t collapsing, as overall vacancies still stand below 5%. “It sure is softening,” he said. “It’s not just normalization anymore.”

While this demand drop follows more than a year of skyrocketing rents, the cost of living doesn’t seem to be a direct cause of demand slowing, according to RealPage. Household incomes among new lease signers are on the rise, up 13% YOY through August. Rent-to-income ratios sit at just above 23%, and rent collections among market-rate renters are up 60 basis points from one year ago.

Demand has also softened across all price points and almost all markets. In fact, Class C properties were the first to show demand weakness, despite lower rents and smaller increases.

“All the headlines right now are focusing on rents, but they’re missing the forest through the trees. Rents are a result of supply and demand,” Parsons said. “Asking rents will fall slightly in September, but that’s not too unusual seasonally. Too much is being made about cuts that [so far] are very slight. The real story is demand.”

Out of 150 major markets, 119 registered negative apartment demand in the third quarter of 2022. Vacancy rose by up to 1.5 percentage points in a handful of markets, including Phoenix, Las Vegas and five Florida markets: Tampa, Fort Lauderdale, Orlando, Jacksonville and West Palm Beach.

At the same time, new apartment construction stands at a 40-year high. More than 917,000 units are under construction, and completions are expected to peak in the second half of 2023. Most new units are expected to be priced for higher-income renters. RealPage anticipates higher financing costs and softer fundamentals will depress new starts in the near future.

Low unemployment rates and strong income growth could work as tailwinds for the market as conditions evolve, according to RealPage.

“Let's hope 2022 is like 2020, when consumers eventually started spending and forming households and moving around in big numbers after an initial freeze,” Parsons said. “[The] key now is to watch jobs and wages and consumer debt. If those numbers hold up as they have, we should see demand come back in strong numbers in spring 2023.