New York City-based rent payment loyalty platform Bilt Rewards has announced a new $200 million equity investment, led by Cambridge, Massachusetts-based venture capital firm General Catalyst, with contributions by Greenwich, Connecticut-based investor Elridge and existing investors Left Lane Capital, Camber Creek and Prosus Ventures. The company is now valued at $3.1 billion.

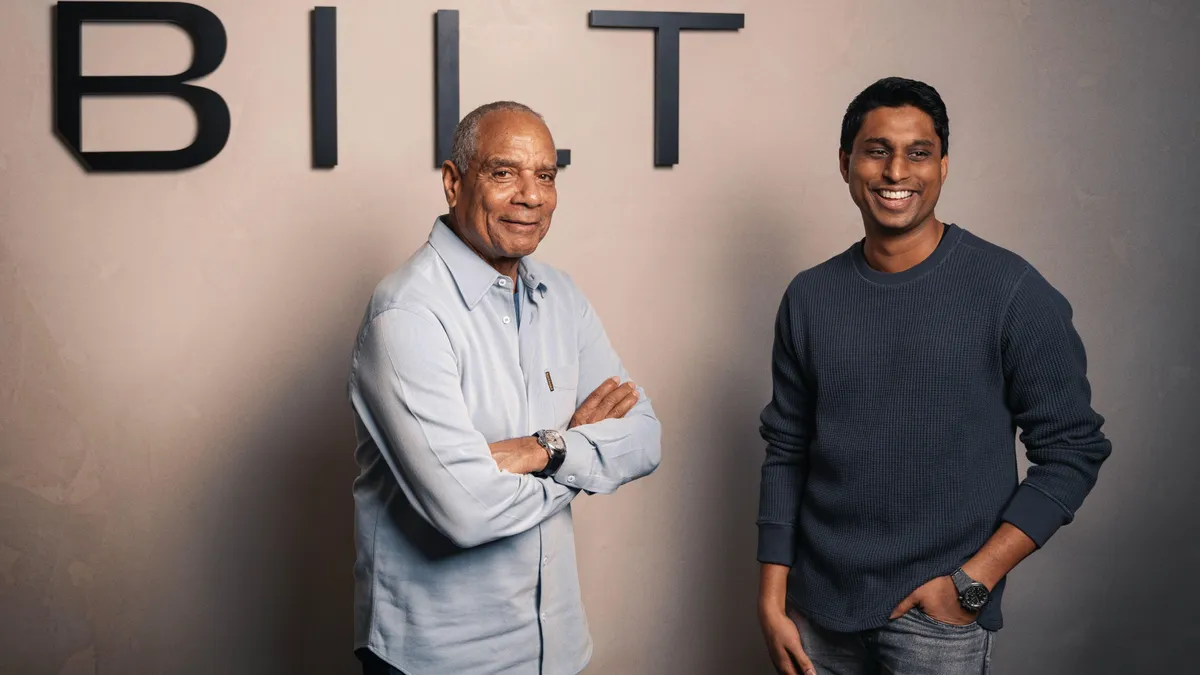

Bilt also appointed Ken Chenault, current chairman and managing director of General Catalyst, as chairman of the board of directors. Chenault is a former chairman and CEO of American Express. Roger Goodell, commissioner of the NFL, is also joining the company’s board as an independent director.

The new $200 million capital infusion will fuel Bilt’s expansion across the multifamily, single family and student housing industries, according to the company. It will also boost Bilt’s new Neighborhood Rewards program, which provides rewards for dining, rideshare and grocery purchases. The company’s future plans include a mortgage payment reward system, according to the release.

First launched in April 2022, Bilt’s rent payment reward program is currently available to almost 4 million households across the U.S. Its annualized member spend is almost $20 billion, and the company achieved EBITDA profitability in 2023.

Multifamily companies that use the Bilt platform include Greystar, Equity Residential, AvalonBay Communities, Bozzuto, Invitation Homes and The Moinian Group, among others. Bilt also recently partnered with RealPage to integrate Bilt Rewards services into its property management software.