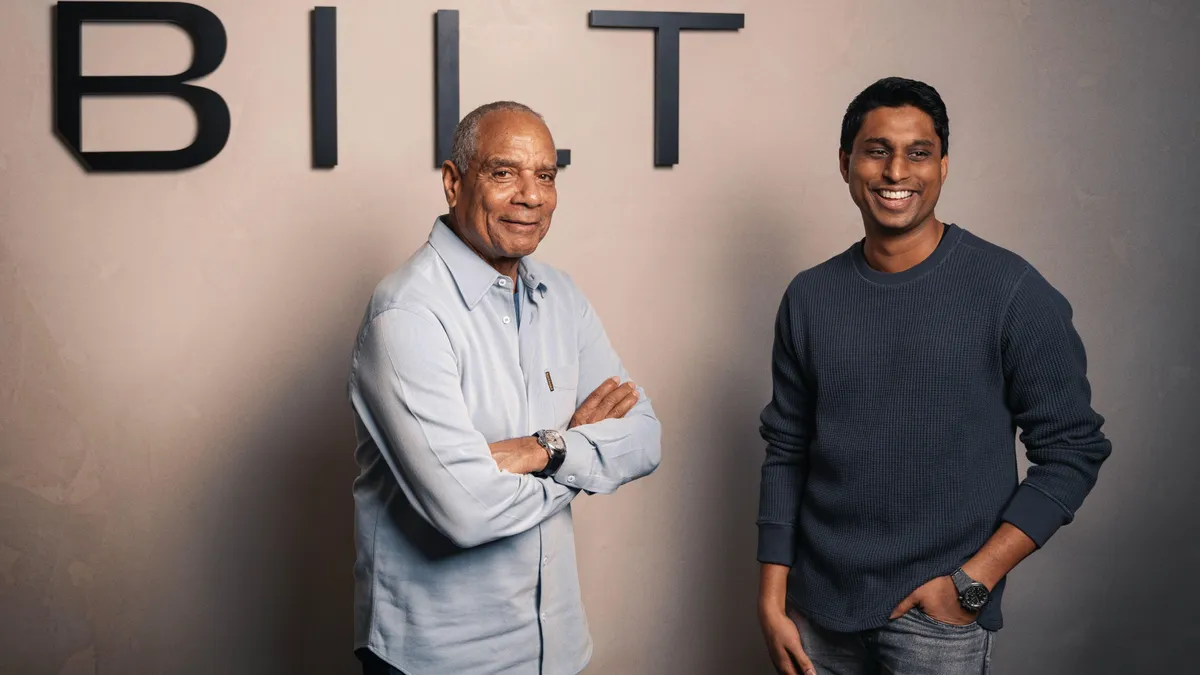

Core Spaces, a Chicago-based developer, owner and operator of student housing, has launched a new investment platform, Global Wealth Management, and brought on two industry veterans, brothers Tom and John Dine, to lead it as managing directors.

The Global Wealth Management division is intended to provide access to Core’s institutional investments for high net-worth individuals and their financial intermediaries, according to the company. These new investment sources will help diversify Core’s capital and fuel the growth of its portfolio, which currently stands at 37,400 beds owned and managed and 35,000 in development. In their new roles, Tom and John Dine will hire and develop a team of professionals to run the platform.

“The fundamentals in student housing remain strong and it’s proven to be an increasingly attractive asset class for private wealth,” said John Wieker, chief investment officer at Core Spaces, in a press release. “We saw an opportunity for individual investors to join us in greater scale as we continue to execute the same investment strategies that have historically proven successful.”

The Dine brothers have over 40 combined years of experience in alternative investment strategies, with a focus on real estate, and have worked together at the same companies for the majority of their careers.

Before joining Core Spaces, they served as directors at New York City-based Apollo Management, where they were responsible for increasing assets under management. They have also served as senior vice presidents at Griffin Capital Securities, which was acquired by Apollo Management in 2022, and vice presidents at New York City-based W.P. Carey. Tom began his career as a financial advisor at Swiss investment bank UBS, while John began as a senior trader in Chicago.

“Core’s unique investment strategy has a proven track record of delivering outsized returns to its long-time institutional investors and, with this new platform, we are bringing the same opportunity directly to the high-net-worth market to share in the financial success of this growing asset class,” John Dine said in the press release.