This story is the first in a series of articles looking at how the rising cost of insurance is affecting apartment owners.

As summer nears, many apartment owners are starting to get a clearer view of their expenses for the year ahead by locking in their insurance renewals. But for many, that certainty isn’t bringing very much comfort.

“We're just doing our renewal as we speak, so we'll have our pricing in the next day or so,” said Michael Becker, the co-founder and principal of Dallas-based SPI Advisory, which owns properties in Dallas, San Antonio and Austin, Texas. “It's a 20% increase if we're lucky, but it's probably higher than that. And that's after having 10% increases over the last however many years.”

Becker isn’t alone. Apartment owners around the country are grappling with skyrocketing insurance premiums. Since the beginning of the year, rates have increased from 20% to 30% to 300%, 400% and even 500%, according to Danielle Lombardo, chair of the Global Real Estate Practice at Kansas City, Missouri–based insurance brokerage firm Lockton.

What's more, owners are getting less for their money. “In almost every situation, coverage is reduced and deductibles are increased,” Lombardo said.

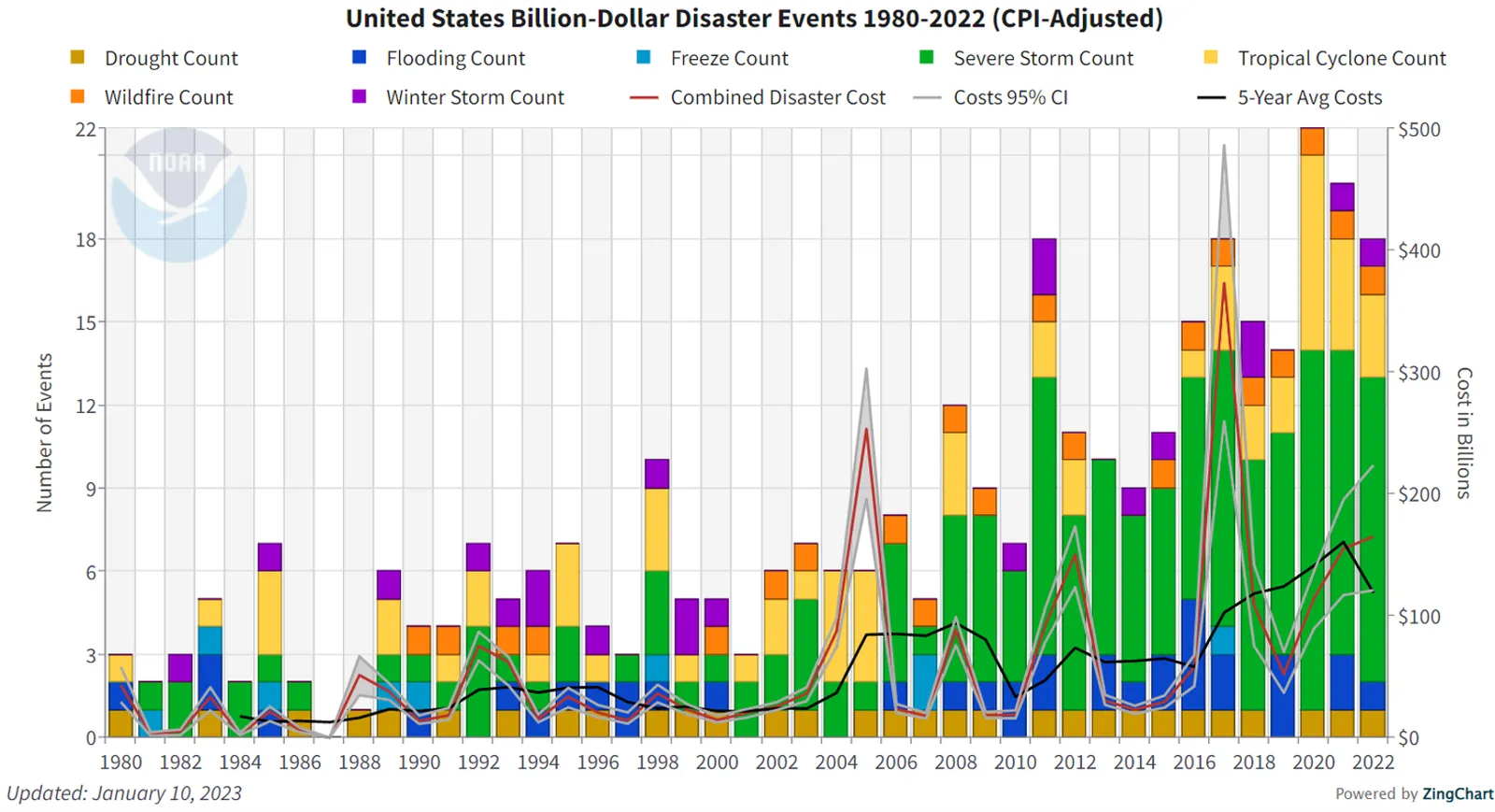

The increased frequency and severity of weather disasters across the country are helping fuel the increase. But those aren’t the only causes. Construction costs, population growth, inflation and the nuances of the insurance market all play a role. “It is hitting everyone and it's not just climate-related,” Lombardo said.

Here are some of the top reasons why insurance costs for multifamily owners are skyrocketing:

Volatile climate risks

Property owners in areas with climate-related risks are getting hit especially hard. In places like Florida, where Hurricane Ian caused $50 billion in damage last year, and coastal Texas, apartment owners are seeing increases on premiums of up to 300% due to windstorms and hurricane exposure, according to Lombardo.

In Florida and Texas, the average insurance cost per unit grew about 37% and 43%, respectively from 2020 to 2022, according to Trepp.

Matthew A. Rieger, president and CEO of Coconut Grove, Florida–based Housing Trust Group, the largest affordable developer in Florida, told Multifamily Dive that he was instructed to budget for 200% to 300% increases. “We are seeing radical, outrageous increases in property insurance and general liability insurance for our product,” he said.

In California, wildfires are the risk. The average insurance cost per unit grew about 33% in the state, from 2020 to 2022, according to Trepp. The situation has gotten so bad that insurance giant State Farm stopped accepting applications for business and personal lines of property and casualty insurance in California in late May, according to CNN.

“California is in that bracket [of higher insurance costs], as well,” said Chris Marsh, general partner of Newport Beach, California-based Revitate Cherry Tree Capital Partners. “The wildfires of 2017 and 2018 here really doubled insurance on some asset classes.”

Replacement costs

In addition to extreme weather events, Florida has seen an influx of new residents. From 1970 and 2020 the state’s total population and population density increased 317%, which was the third-largest growth rate among U.S. states and twice the overall national growth rate, according to the U.S. Census Bureau. With more density along the coast, storm damage is multiplied.

“The problem with Florida is it's the riskiest piece of land in the world,” Lombardo said. “And it's had the most population growth as well.”

The rising price of building is also a problem. In a report released earlier this year, Yardi cited increases in construction costs from inflation, labor and supply chain issues and the growth in property values as drivers of increased insurance costs.

Lombardo also sees increased construction costs and inflation as drivers of increases.

“The way that property insurance is calculated is at a rate times the replacement cost value,” she said. “So if the replacement cost values increase — almost all insurance carriers are forcing replacement cost values up — that has a direct correlation to the increase in premium.”

Industry pressures

As extreme weather events become more common, there are increased concerns that insurers’ business models won’t keep pace with the growing frequency and severity of catastrophes, according to Yardi.

Insurers move portions of risk off their balance sheets by selling it to reinsurers. However, those reinsurance companies have stopped servicing high-risk states or are raising rates by 45% to 100% if they stay, according to Yardi.

“The reinsurance marketplace has such a volatile reaction to what's going on from a catastrophe perspective,” Lombardo said. “If they pull out, then the primary insurers can't use reinsurance on their balance sheet. As a result, the insurers are then pulling out.”

If reinsurers see too much risk in the casualty market, they can put their money in other places, making it even less appealing to back multifamily policies. “Folks that are reinsurers can invest in a lot of different things,” Mark Parrell, CEO of Chicago-based REIT Equity Residential, said on the company’s Q1 earnings call in May. “And the fixed income market and maybe even these beaten-down equity values may be more interesting to them.”

National issues

While weather events in Florida and Texas may pummel owners in those states, they’re pushing costs for multifamily operators around the country. Rieger knows this firsthand. When wildfires hit California, his premiums in Florida went up.

“If they're getting hit in California or Florida, they're going to make the guy in South Carolina or North Carolina subsidize it,” he said.

And now that disasters are hitting his home states, insurance costs are rising in other places. “The premise of insurance is that the losses of a few are paid by many,” Lombardo said.

Click here to sign up to receive multifamily and apartment news like this article in your inbox every weekday.