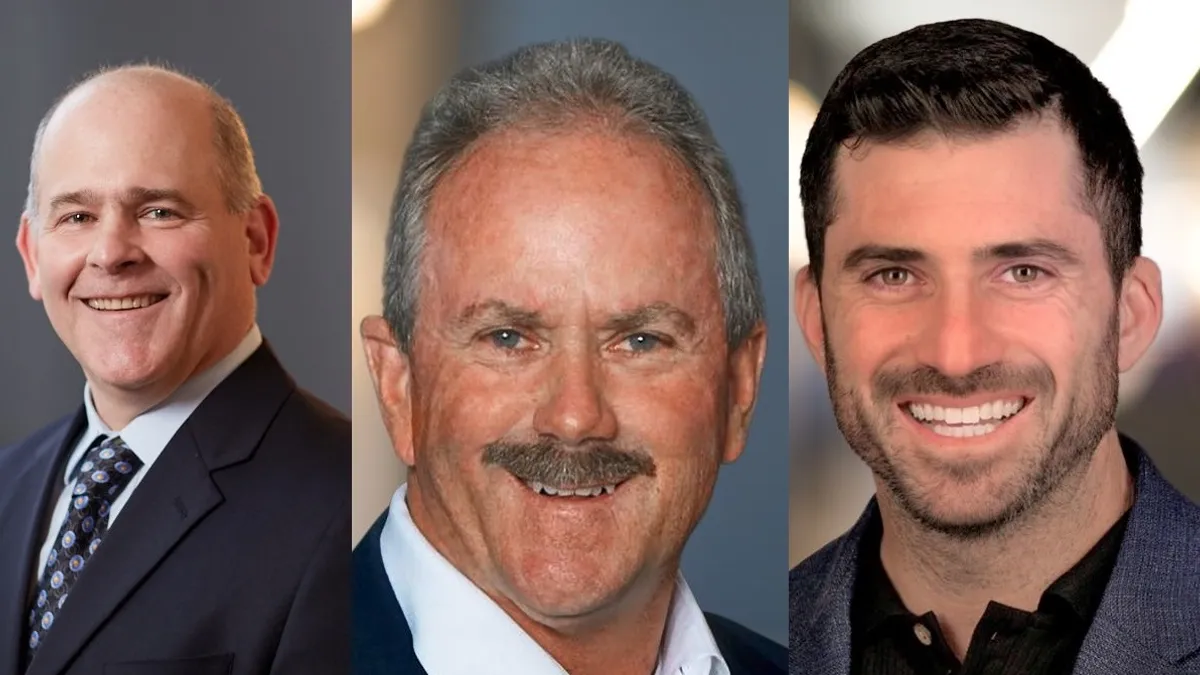

Dallas-based multifamily investor Knightvest Capital has appointed Madison Tappan, previously managing director of acquisitions, as its new chief investment officer.

In his new role, Tappan will oversee Knightvest’s acquisition strategy and lead the firm’s portfolio expansion in Sun Belt markets. He will also work on deploying capital from Knightvest’s most recent investment fund, with a focus on acquiring and renovating 2000s-era properties.

"Madison's proven track record, deep knowledge of the multifamily sector and strong leadership make him the ideal person to guide our investment strategy," said David Moore, founder and CEO of Knightvest Capital, in the release. "As we enter the next phase of our growth journey, Madison will be instrumental in advancing our mission to create communities of excellence and deliver dependable, market-leading returns."

Tappan began his real estate career at Knightvest in 2014, where his roles included director of investor relations. Following his first period at Knightvest, Tappan joined New York City-based Goldman Sachs’ U.S. Real Estate team, overseeing the company’s multifamily investments across the Southeastern and Southwestern U.S. He then returned to Knightvest as managing director of acquisitions, with a focus on properties in the Dallas-Fort Worth area.

“It's a privilege to step into the CIO role at such an exciting time for Knightvest," said Tappan in the release. "I look forward to building on Knightvest's strong track record by identifying compelling investment opportunities that deliver long-term value for our investors and strengthen the communities we serve."

Knightvest has invested over $10 billion into more than 60,000 units across high-growth metros in Texas, Arizona, the Carolinas and Florida over the past 15 years, according to its website. The firm currently maintains a portfolio of more than 34,600 units and ranks No. 30 on the National Multifamily Housing Council’s latest NMHC Top 50 Owners list.