Dive Brief:

- A staggering $351.8 billion in multifamily bank loans will mature between 2023 and 2027, according to a Trepp analysis of the Fed Flow of Funds data.

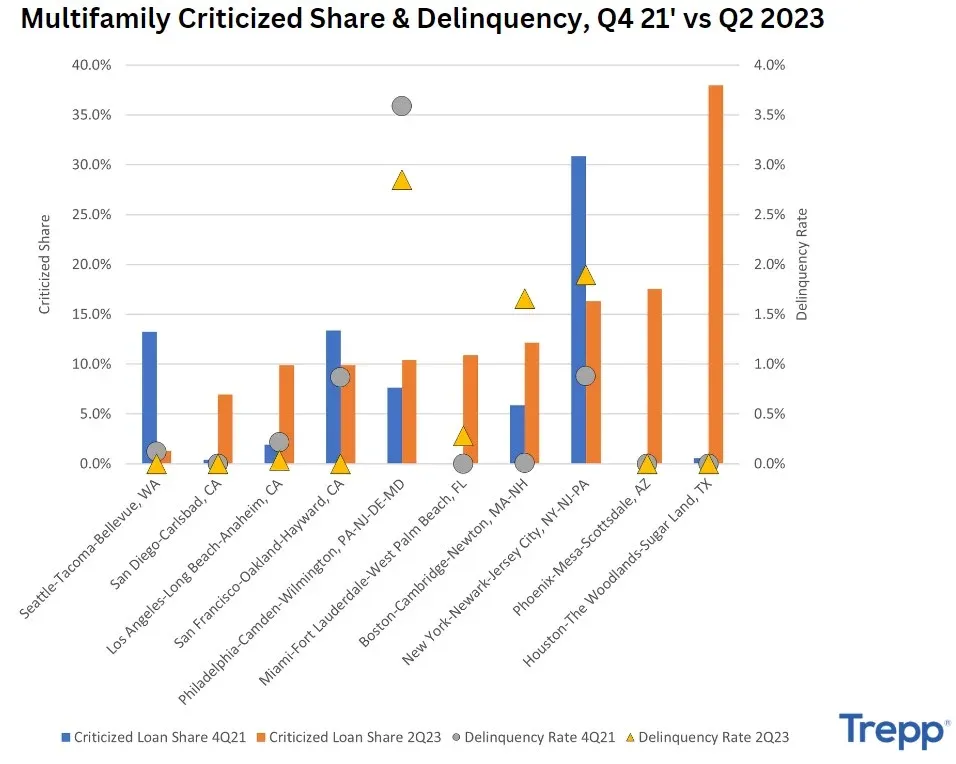

- In a recent article, Trepp rated loans on a scale of one to nine. Loans rated at one had the lowest probability of default, while those at nine were in default. Anything above six was considered a “criticized” loan.

- Out of the 10 markets with the highest loan balances, only the New York City, San Francisco and Seattle markets saw decreases in criticized loans from the fourth quarter of 2021 to the second quarter of 2023. The remaining seven markets have experienced increases.

Dive Insight:

In its analysis, Trepp noted that multifamily markets seem to be on two distinct paths. New York City, San Francisco and Seattle, which struggled during and immediately after the COVID-19 lockdowns, are starting to see rent growth.

Still, some apartment REITs have reported continuing concerns in West Coast markets. In the third quarter, San Francisco and Seattle had rental rate declines that were more pronounced than usual seasonal patterns, according to Chicago-based Equity Residential CEO Mark Parrell on the company’s third-quarter conference call. “The main culprit here seems to be a lack of job growth for our target renter demographic,” he said.

However, many markets that saw strong demand during the pandemic are beginning to experience issues.

“This weakness is coming from a combination of supply-and-demand imbalance putting downward pressure on rent growth, higher expenses putting strain on property owners’ bottom lines, higher-for-longer interest rates becoming a concern for loan maturities and anticipated economic recession,” according to Trepp.

Most notably in the Sun Belt markets, new supply is putting pressure on rents, which could stress bank notes in some metros. Houston, which saw the highest criticized loan share at 38%, is one of those markets.

“Houston’s multifamily market is facing weak absorption rates and rental growth decline, with a strong construction pipeline also threatening to push occupancy even lower,” Trepp wrote. “Being located near the coast, multifamily property owners are already facing increasing insurance premiums as well as other maintenance and repair costs from weather damage.”

Phoenix, traditionally a boom-or-bust market, is also seeing a sharp rise in new deliveries. The percentage of commercial mortgage-backed securities loans on the servicer watchlist reached 52.6%, one of the highest rates nationally.

“The delinquency rate for bank-held multifamily loans in the Phoenix region is still at 0.0%, but with over-supply and looming concerns of a recession, the spike in the criticized loan share is indicating perceived risk coming down the line for these loans,” Trepp wrote.

Click here to sign up to receive multifamily and apartment news like this article in your inbox every weekday.