Dive Brief:

- Multifamily starts are expected to decline by 20% in 2024, according to the National Association of Home Builders.

- A total of 472,000 new multifamily units broke ground in 2023, down 14% from 2022. The NAHB anticipates that starts will fall to 379,000 total in 2024.

- Despite this dip, approximately 1 million multifamily units are currently under construction, the highest level since 1973, according to Danushka Nanayakkara-Skillington, assistant vice president for forecasting and analysis at the NAHB. However, falling starts will mean this number is due to drop.

Dive Insight:

While the year has only just begun, the construction market’s slowdown is apparent from January data alone. Starts for buildings with five or more units fell 37.9% year over year in January, down to 314,000, according to HUD and the U.S. Census Bureau.

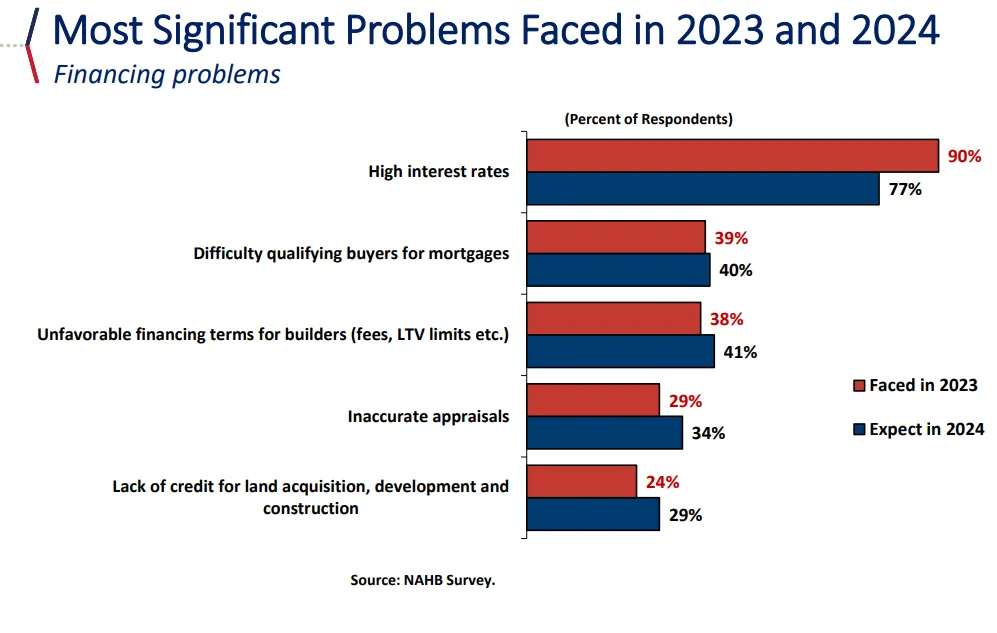

High interest rates were the most widely cited obstacle for multifamily builders and developers in a survey conducted by the NAHB. “Tight lending conditions and the high cost of development loans continue to hinder additional multifamily housing production,” Nanayakkara-Skillington said at a press conference held during the International Builders’ Show in Las Vegas last week.

Adding on to these difficult conditions is a shortage of skilled labor — over 400,000 workers’ worth, according to the NAHB. In the survey, 73% of builders cited the cost and availability of labor among their most significant problems in 2023, and 71% expect this to continue in 2024.

“Attracting skilled labor will remain a key objective for construction firms in the coming years,” Nanayakkara-Skillington said.

Another headwind is ongoing shortages of building products and materials. Sixty-three percent of builders reported this as a problem in 2023, and 58% expect it to continue. While conditions have improved since 2022, according to NAHB Economist Eric Lynch, appliances, windows and doors, HVAC equipment, plumbing fixtures and fittings and cabinets are among the most difficult products to get.

As a glut of new units comes online in 2024, the NAHB expects rent growth to slow, which should ease inflationary pressures. However, it will still have a dampening effect on multifamily performance in the near future. The market is due to stabilize in 2025, according to the NAHB, with 388,000 units set to start.