Dive Brief:

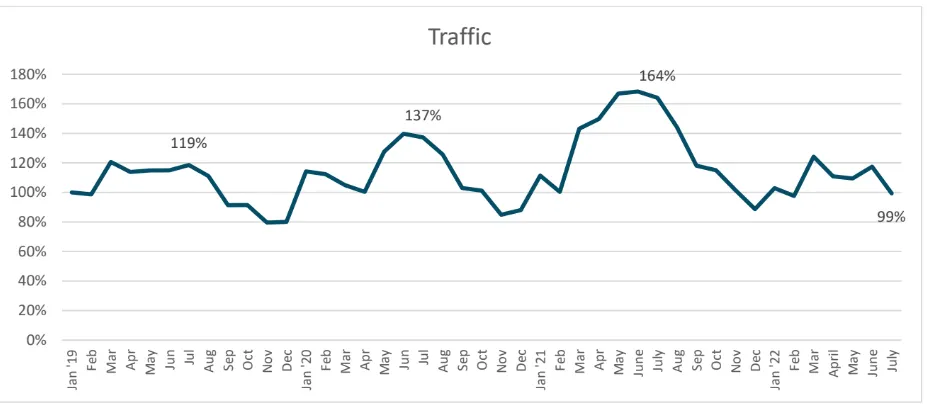

- Following a recent surge in rents, two measures of renter interest – applications and traffic — fell in July, leading to a rise in vacancies. This, in turn, has softened pressure on prices, according to a new report by MRI Real Estate Software.

- While July is usually the peak month for leasing, potential tenant traffic peaked in March 2022 and has since fallen off from the traditional seasonal patterns. July 2022’s traffic represented only 80% of March traffic and 61% of July 2021 traffic.

- New applications also peaked in March, then fell to 76% of March volumes in July. Move-ins are on the rise, but remain off historical averages, having underperformed by about 10% since October 2021, the report said.

Dive Insight:

The average price of a new 12-month lease fell slightly from June to July, down from $1,830 to $1,818 per month, according to MRI data. However, it is still well above recent trends, growing from an average of $1,744 from January through May.

Despite these conditions, renewal rates rose 9% YOY in July. This marks the 15th straight month of year-over-year renewal improvements, despite record high prices — the average price for a 12-month renewal was $1,639 in July, up 16% from 2021.

“Tight occupancy led to rising prices, but now we’re seeing dampened demand, which, in turn, is leading to reductions in pricing,” said Brian Zrimsek, industry principal at MRI Software, in a press release. “Other factors, such as inflation and low rates of unemployment, are also having an impact on market conditions.”

Despite these rising prices, delinquency on rent payments has normalized in recent months. On-time payment rates stand at just under 94%, about 2% lower than the pre-pandemic norm, but in line with payment rates over the past year.

MRI expects multifamily performance to continue to cool, particularly as the economy does the same.

“As we exit the summer and head for the traditionally slower seasons, we expect prices to ease,” said Zrimsek. “Macroeconomic factors, largely inflation and employment, as well as back-to-office trends, will color renter behavior through the end of the year.