Every one of the 52,350 units that Salt Lake City-based Bridge Investment Group owns and manages in suburban garden-style properties across the country is individually metered, with gas and electric bills paid by residents. That makes it difficult — if not impossible — for BIG to compare energy use across properties, let alone set decarbonization and net-zero energy goals.

“The key challenge in multifamily sustainability reporting right now is simply access to full asset utility data,” said Isela Rosales, managing director and head of ESG and Sustainability at BIG. “How can you compare or even acknowledge what is happening at your properties if you only get that very partial picture?”

Juliette Apicella, director of sustainability for Atlanta-based Gables Residential, which owns and manages 25,000 units nationwide, agrees that “capturing whole-building data is one of the biggest challenges we face.”

Gables has been reporting to the Global Real Estate Sustainability Benchmark — which provides transparent environmental, social and governance data to financial markets — since 2012, and is committed to net-zero energy use by 2050. ESG criteria are standards used by investors to screen for how effectively companies are addressing things like climate change, relationships with employees and communities and internal audits and shareholder relations.

“Energy data is directly tied to greenhouse gas emissions data,” Apicella said. “So, it’s important for us to understand and use these metrics for how our buildings are performing, how well we’re operating our buildings and where we need to make investments for energy-efficiency projects in order to meet our goals.”

The building sector is responsible for about 40% of energy usage and associated CO2 emissions in the United States, but the operations used to monitor most commercial real estate are antiquated, according to the U.S. Department of Energy. With $2.7 trillion invested in global ESG funds every year and the U.S. Securities and Exchange Commission considering new rules requiring public companies like Gables to provide climate-related financial data and greenhouse gas emissions insights, leveling up energy data and reporting has never been more important.

“Because GRESB is now putting so much weight in whole-building data, it’s important for us to access this data for reporting, as well as to understand how our buildings are functioning as a whole,” Apicella said.

Tech solutions

“Investors, residents, stakeholders and the government all want to know: Are your buildings using more energy than they should be?” said Jameson Hartman, vice president of Park City, Utah-based multifamily-focused venture capital firm RET Ventures. “If you’re going to report on it, you need to get that data in some manner.”

Plus, Hartman added, collecting and reporting ESG data improves building efficiencies: “You can’t figure out what’s broken if you don’t have the data to figure it out in the first place,” he said. “It helps inform decisions around what things are broken and what things are inefficient.”

In its efforts to help multifamily owners and operators find energy and emissions-tracking technology startups that are making it easier to capture the data they need, RET has invested in Measurabl, a data management solution used by commercial real estate companies in 90 countries to measure, manage and report ESG data.

A number of other startups — including Verdigris, Vutility, Redaptive, Utility API and Smappee — have also launched to address the issue, and Rosales is hearing from many of them. “I’ve got vendor meeting requests coming out of my ears,” she said.

Every company offers a slightly different, often proprietary, solution, from hardware to software. When she meets with them, Rosales said, “I’ve had to get smarter with my questions. I need to be specific in that I’m looking for a solution for a Class B or C, low-rise suburban type of multifamily product that is very different from a high rise.”

BIG is doing pilot programs with a few startups that have recently started targeting the multifamily sector, and Gables is looking at a system — whose name Apicella would rather not disclose — that would allow it to get real-time data from sensors placed at a circuit level within single meters.

Looking ahead

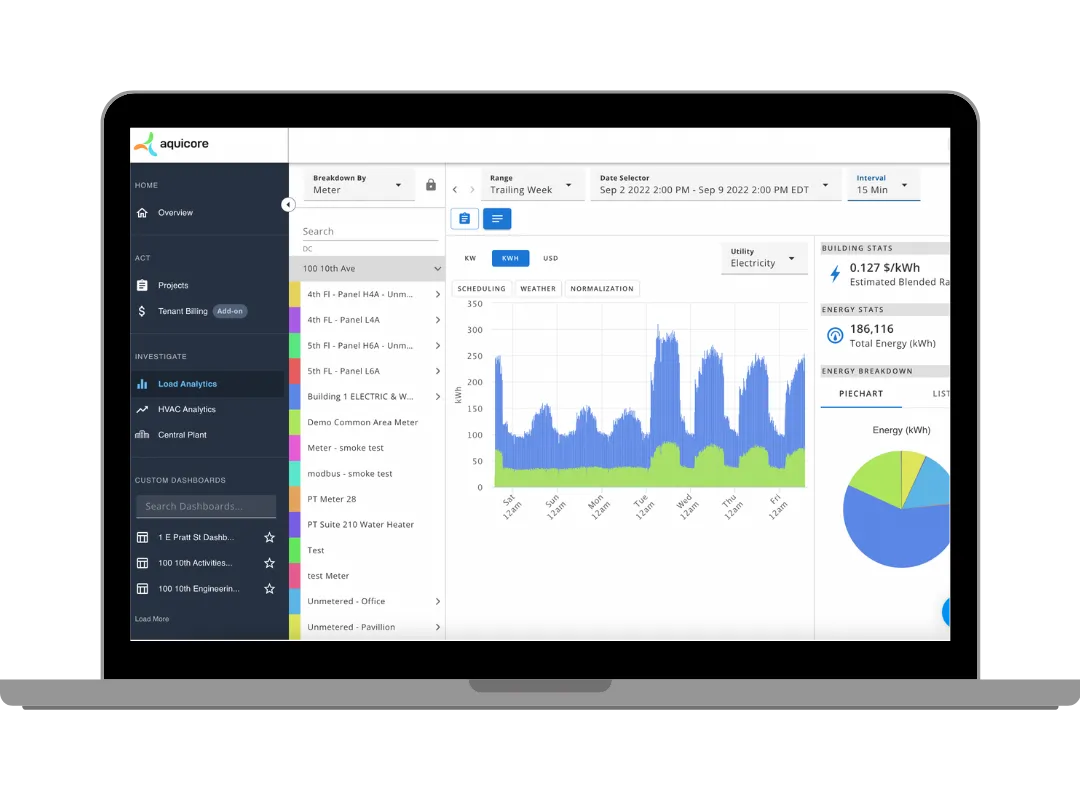

Multifamily has been slower than other industries to seek out solutions to capture and disclose energy and emissions data and ultimately improve performance, said Michael Sutter, director of customer engagement for Washington, D.C.- based Aquicore, which launched a diagnostic platform in 2019 that uses AI, machine learning and rules-based automation to detect energy usage anomalies and perform utility- and building-performance assessments.

Nevertheless, over the past 18 months, Aquicore has seen an influx of requests from multifamily companies for its ESG data and analytics platform, said marketing director Zoe Williams. “Owners and operators are finding that they suddenly really need a solution because the pressures are growing so much more intense, so rapidly.”

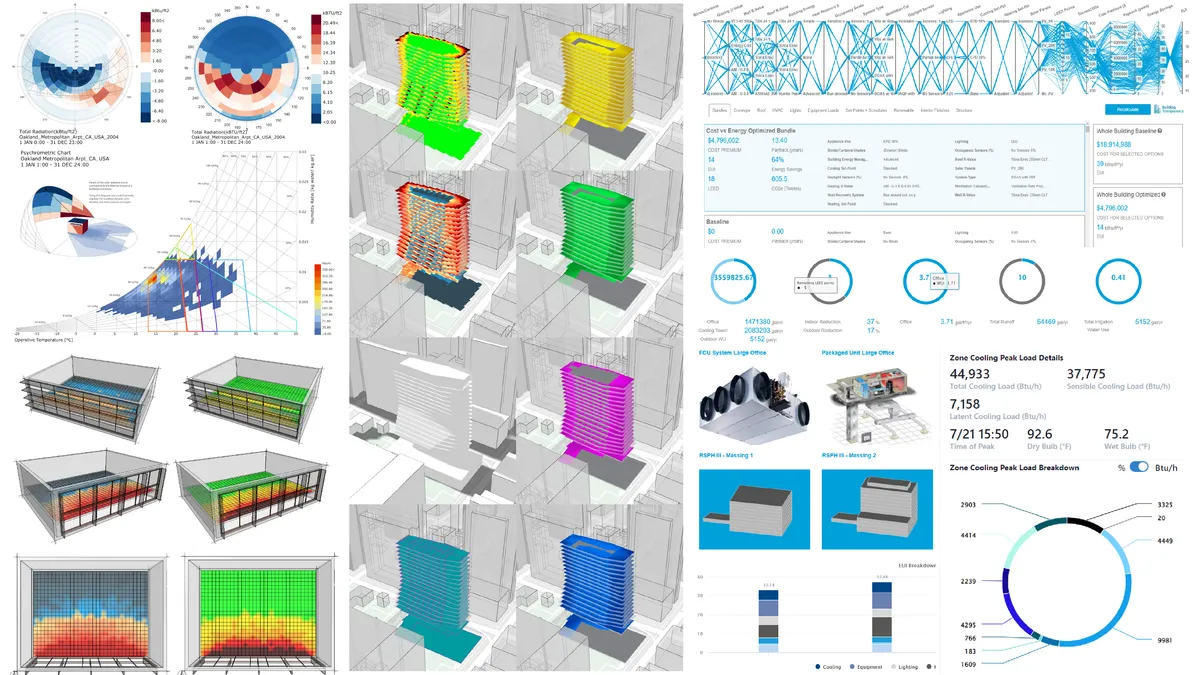

“Buildings represent 40% of carbon emissions, so if we don’t figure this out, it’s not going to go well for the world,” said Patrick Chopson, co-founder of cove.tool, a web-based platform that lets companies track progress toward ESG goals as they design, construct and retrofit buildings. “But I think, at the same time, people forget that this is the largest, most amazing business opportunity we’ve ever seen.”

Cove.tool allows owners and operators to make data-driven design decisions that consider potential costs, carbon impact and resident wellbeing benefits. Multifamily operators can sort through thousands of different combinations of design options and energy systems to optimize buildings for the lowest operating costs and highest energy performance — often enabling them to charge a premium for a green building that can offer residents lower utility bills.

“If you do the financial analysis rather than the gut analysis, you’re going to see that rents are higher and assets perform better” in buildings that meet ESG standards, Chopson said. “If you can look past the politics of this and look at the money side of it, it makes a lot of sense.”