Dive Brief:

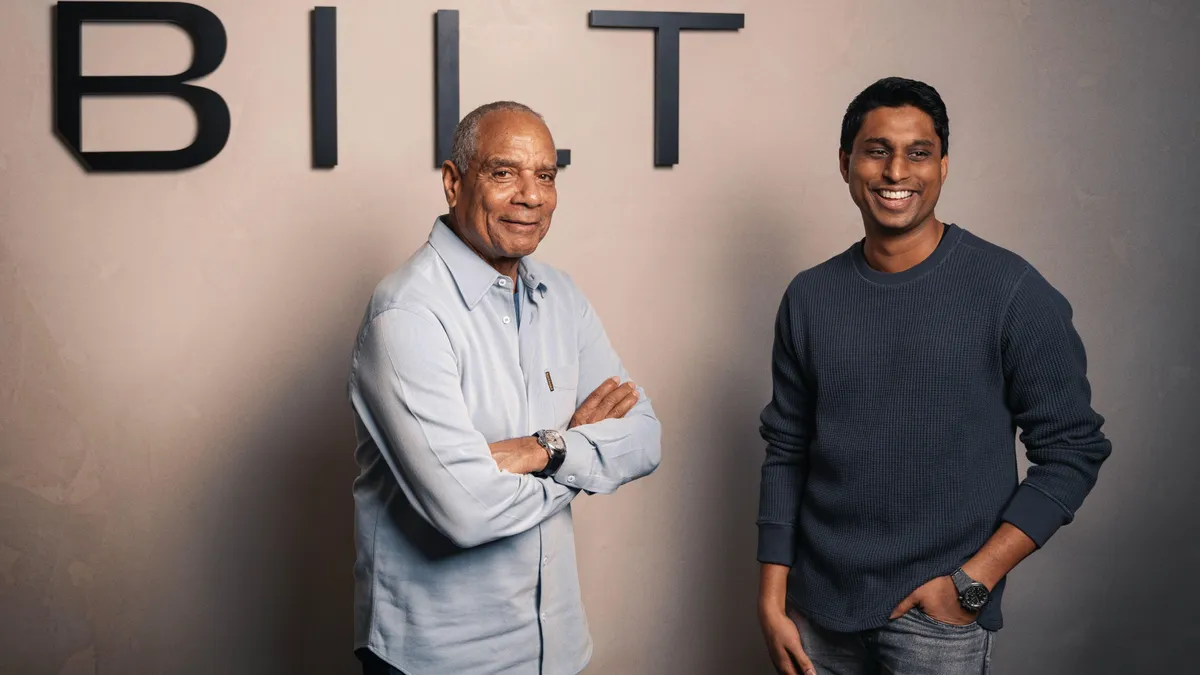

- Scott Maddux has been named the CEO of Westlake Village, California-based rental housing developer and operator Sunstone Two Tree, effective June 18.

- Co-founder and CEO John Maddux will become executive chairman of the company. He is stepping down from the CEO role to serve for three years as the mission president of the Costa Rica San Jose West Mission for The Church of Jesus Christ of Latter-day Saints.

- Scott Maddux, son of John Maddux and president of Sunstone Two Tree since March 2023, joined the company due to the 2022 merger between Sunstone Properties Trust and Two Tree Capital, the latter of which he co-founded with his father to pursue the build-to-rent market.

Dive Insight:

Sunstone Two Tree focuses on high-growth markets throughout the United States. Before founding Two Tree Capital, John Maddux was senior vice president at Oaktree Capital in Los Angeles and also worked on the real estate teams at Blackstone and Goldman Sachs in New York City.

“The company has become a formidable owner, operator and fund manager in the rental housing space and has successfully expanded during a challenging period for the real estate industry,” John Maddux said in the release.

While the company wouldn’t share the size of its portfolio, Scott Maddux told Multifamily Dive it had “thousands of units across five states.”

The portfolio had been larger, but Sunstone Two Tree sold most of its multifamily holdings in 2021 and 2022. “We looked around in the environment and recognized that values were at all-time highs and had been in many ways inflated by the low-interest rate environment,” Scott Maddux said.

Buying mode

Now, Scott Maddux estimates that values have fallen 25% to 35%, depending on the market, and Sunstone Two Tree is in a position to go on the offensive, whether it’s starting ground-up development or purchasing new assets.

“With prices having come down to attractive levels, we're able to go back into growth mode and use the team that has been in place for many years and start to buy again,” Scott Maddux said.

In December, the company bought a 384-unit property in Houston, and it has a couple more assets under contract in addition to some developments. It wants to deploy $1 billion in high-growth markets like Las Vegas, Phoenix, Houston, Dallas and Tampa, Florida, over the next few years.

“It's really just about taking this platform and just accelerating our acquisition phase, continuing forward with our developments and not getting creative or doing a lot of new things,” Scott Maddux said. “We’re just trying to optimize our deployment of capital into this environment.”

Click here to sign up to receive multifamily and apartment news like this article in your inbox every weekday.