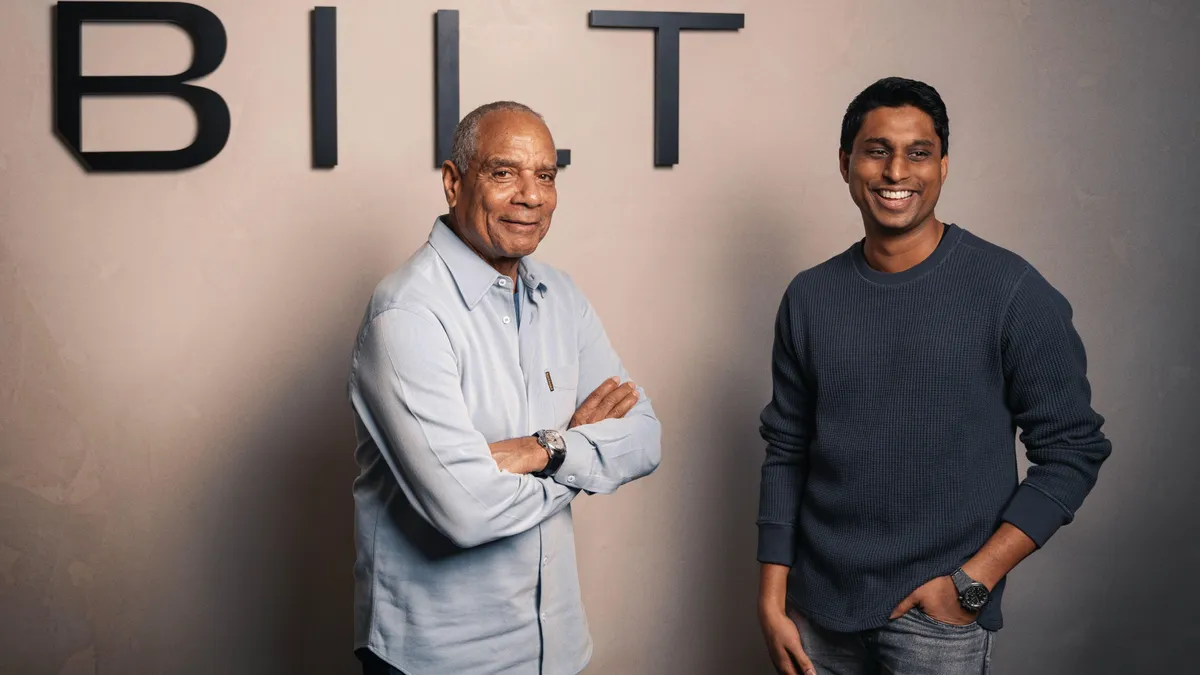

Dallas-based multifamily investor and operator TDI has added Graham Johnston and Patrick Crawford, co-founders of Dallas-based housing platform Riata Development, to its leadership team as senior vice presidents and partners, according to a news release.

In their new roles, Johnston and Crawford will work with Brent Ball, who joined TDI as president and partner in April, to maximize the value of existing assets, raise capital and expand the company’s focus on attainably priced housing.

Johnston will lead the company’s efforts to provide housing for middle-income renters, while Crawford will be responsible for TDI’s investment strategy, deploying capital in preferred equity multifamily investments and tax-exempt bond investments.

Before co-founding Riata Development in 2021, Johnston was the vice president of development and acquisitions at Foster City, California-based multifamily firm Legacy Partners. He has been involved with the development of over 5,000 apartment units, collectively valued at over $900 million.

“Focusing on housing development for the past 10 years, I have seen firsthand the affordability crisis our country, and especially this state, face,” Johnston said in the announcement. “Joining TDI provides a significant platform to develop solutions to this crisis and institute meaningful change for our community.”

Crawford advised on over $1 billion in client transactions as a part of the Value Inc. consulting firm. “I have a passion for working to solve the issue of attainable housing supply, and I’m excited to join this team and do that on a larger scale,” Crawford said.

While Riata Development will remain in existence as a separate entity from TDI, Johnston and Crawford have shifted their full-time focus to their new roles, according to Chelsea Sweat, a representative of TDI.

Formerly an entity of Dallas-based multifamily firm JPI, TDI owns and operates 31 real estate assets valued at $3.7 billion — five in Southern California and 26 in the Dallas-Fort Worth metroplex. The entity and its properties were not included as part of the sale of the JPI operating platform to Addison, Texas-based Sumitomo Forestry America, a subsidiary of Japan-based Sumitomo Forestry Co, according to the release. The company expects to close on several new projects in the coming weeks.

“Affordable housing is not a new issue for DFW,” Bobby Page, co-founder of TDI and former co-owner of JPI, said in the announcement, “but it’s becoming more challenging every day as the population grows and inflation continues to drive up housing costs.”