After the turbulence of the pandemic years, the multifamily market may be finally calming down. With rent growth normalizing and vacancy rates beginning to settle into a new norm, the latest CoStar data from the third quarter of 2023 suggests a less bumpy period ahead.

Shifts in rent growth start to slow

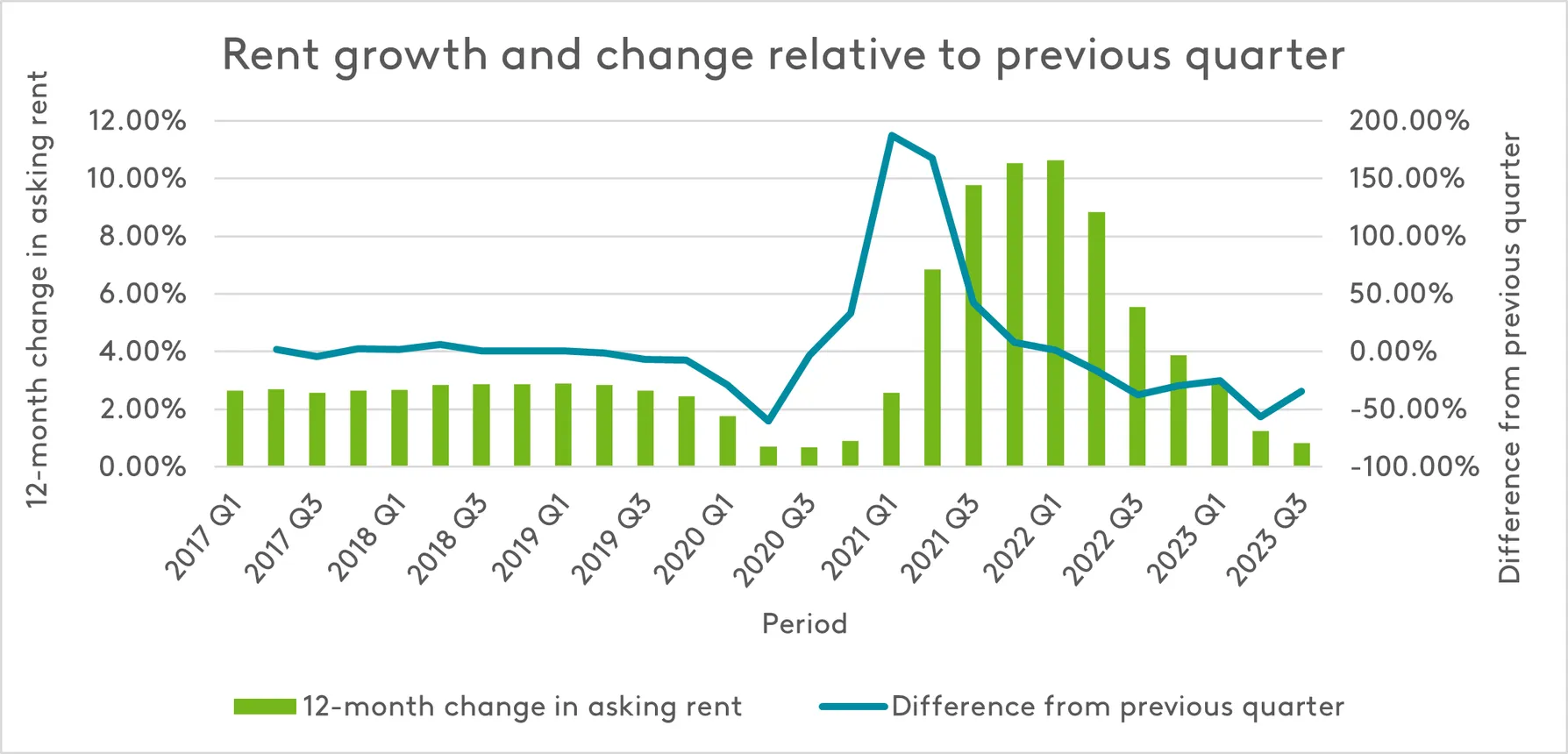

In 2021, the multifamily industry reaped its largest ever gains in rent growth. More and more renters chose to pack up and move during the pandemic, and apartment owners and operators saw a flood of new residents.

After dropping briefly in 2020, rents soared in 2021, and national averages doubled and tripled. At its peak in the first quarter of 2022, year-over-year rent growth skyrocketed into double digits.

Since that high, rent growth has been on the decline. Growth in national 12-month asking rent is currently well under 2%, and the dramatic spikes and drops seen in the last few years have been replaced with smaller quarter-to-quarter shifts.

Vacancy rates settles into a new normal

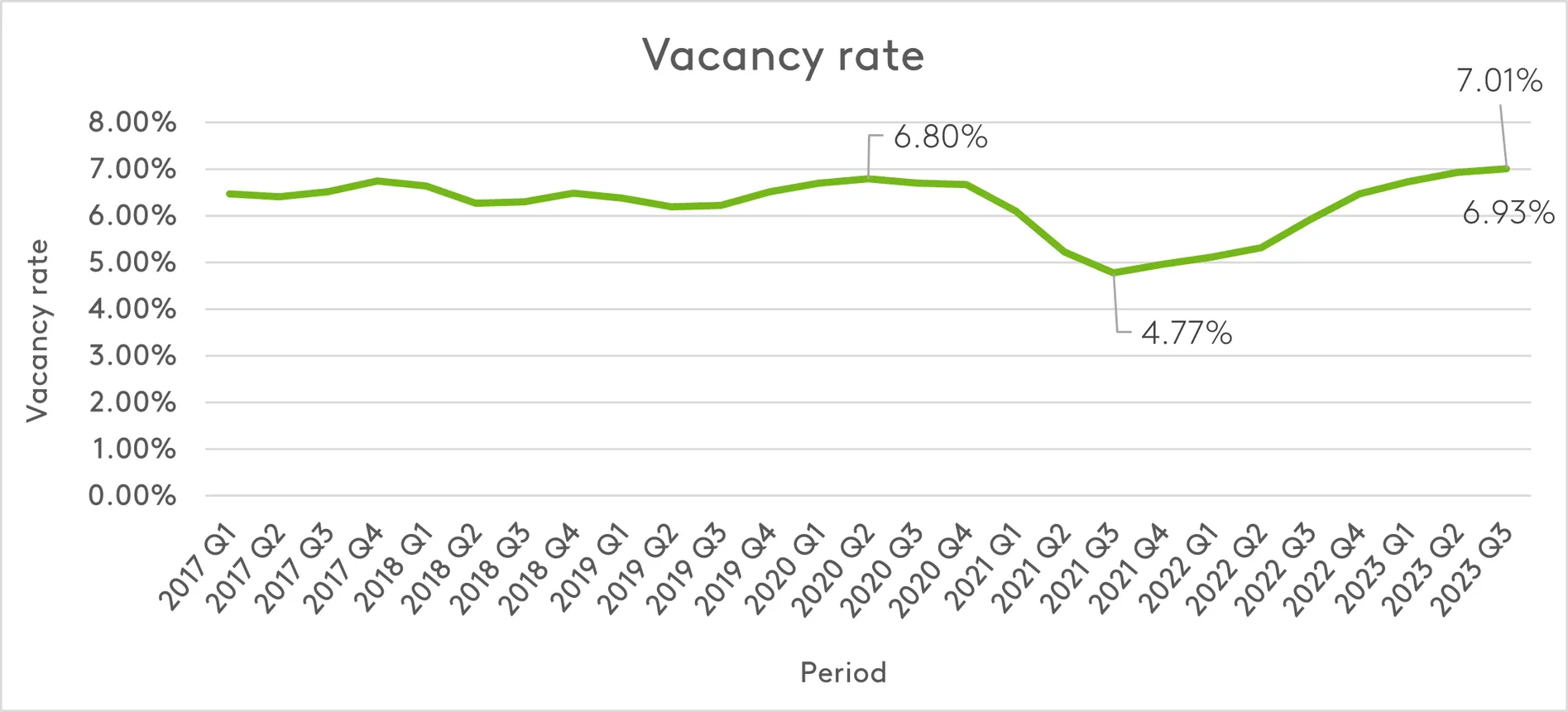

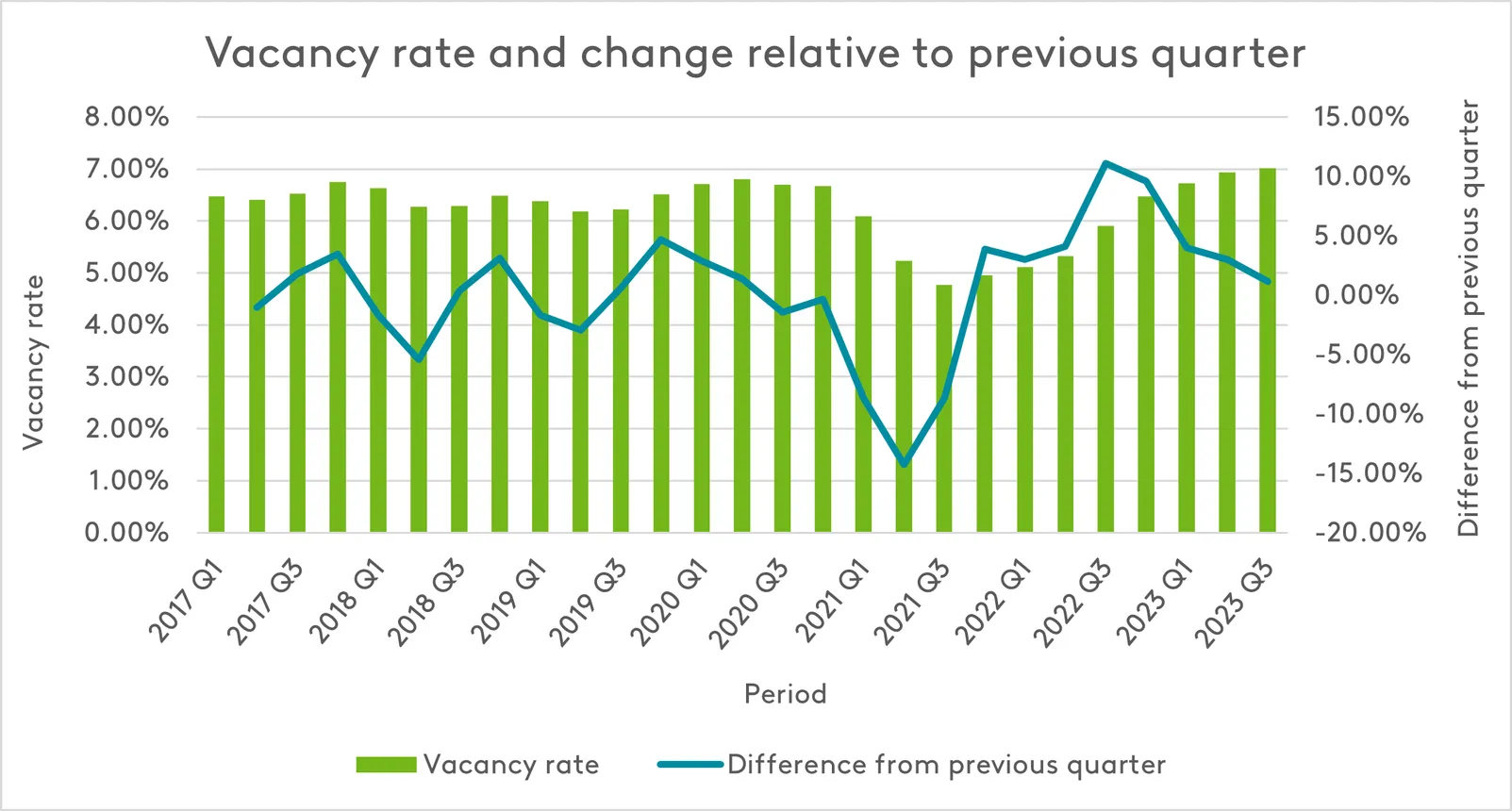

Before the pandemic, vacancy rates had stabilized between 6% and 7%. Quarterly differences consistently fell between negative and positive 5%.

But with pandemic-era turbulence, vacancy dropped under 5% in the third quarter of 2021, hitting a new low.

In 2023, vacancy rates have hovered around 6% and 7%, with little change from quarter to quarter. This trend could indicate that the swings in vacancy have begun to calm down.

While still higher than pre-pandemic historic averages, vacancy is now stabilizing around 7%.

Volatility in multifamily market begins to ease

It remains to be seen whether these stabilizing trends continue. If the current trajectory holds, the storm clouds over the multifamily industry may be fading. Though much lower than in years past, rent growth appears to be settling into a new normal. Vacancy rates are also beginning to moderate.

After the dramatic swings during the pandemic, this new stability could offer the multifamily industry some much-needed relief.