Transactions

-

Why Madison Communities tripled down on Asheville

The North Carolina-based multifamily developer sees a lot of upside in the long-term fundamentals of the mountain town.

By Leslie Shaver • Dec. 12, 2025 -

Price tag grows on Toll Brothers’ sale to Kennedy Wilson

The sale price for the apartment platform increased by $33 million to $380 million, while the closing date was pushed to 2026.

By Leslie Shaver • Dec. 11, 2025 -

Multifamily pros react to Fed interest rate cut

Apartment executives welcomed the 25 basis point trim as the central bank signaled one additional rate reduction for 2026.

By Leslie Shaver • Dec. 10, 2025 -

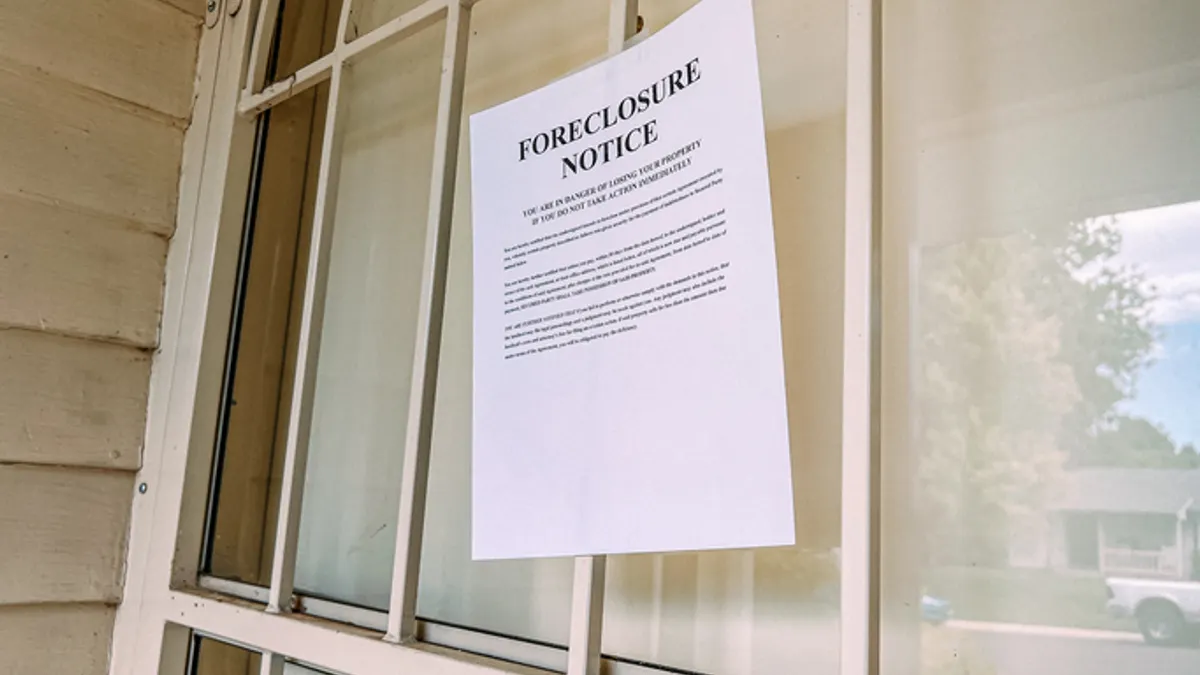

Apartment distress ticked up in November

The multifamily distress rate rose 50 basis points MOM to 10.80%, reflecting struggles with floating-rate debt and operating expense inflation, according to CRED iQ.

By Leslie Shaver • Dec. 9, 2025 -

Hudson Valley Property Group acquires 170 units in New Jersey

The firm is planning approximately $7.6 million in renovations to modernize the affordable buildings and enhance energy efficiency and security.

By Leslie Shaver • Dec. 8, 2025 -

Tailwind enters San Francisco, Las Vegas with $60M portfolio purchase

The California-based apartment owner and operator acquired three properties in an off-market transaction from a motivated long-term family owner.

By Leslie Shaver • Dec. 4, 2025 -

Q&A

Why CAPREIT is eyeing more management growth

After being selected by Affordable Homes & Communities to operate 21 properties, CEO Andrew Kadish sees the opportunity to secure more affordable contracts.

By Leslie Shaver • Dec. 2, 2025 -

Multifamily delinquencies fell back below 7% in November

Even with the one-month reprieve, one industry observer sees apartment distress rising into 2026.

By Leslie Shaver • Dec. 2, 2025 -

Apartment sales dropped 28% in October

Prices rose 0.5% year over year, while cap rates fell 10 basis points to an average of 5.5%.

By Leslie Shaver • Dec. 1, 2025 -

FHFA hikes multifamily lending caps for 2026

The $30 billion increase will allow Fannie Mae and Freddie Mac to purchase up to $176 billion in multifamily loans next year.

By Leslie Shaver • Nov. 25, 2025 -

Draper and Kramer makes big hometown buy

The Chicago-based firm acquired Eleven33, a 12-story, 263-unit luxury rental community in nearby Oak Park, Illinois.

By Leslie Shaver • Nov. 24, 2025 -

Broad Creek Capital closes first multifamily fund

In addition to wrapping up a $150 million investment vehicle, the Washington, D.C.-based firm acquired an off-market property in Charlotte, North Carolina, for $94 million.

By Leslie Shaver • Nov. 21, 2025 -

What the major apartment REITs bought and sold in Q3

AvalonBay traded properties from the 2013 Archstone sale, while Essex disposed of three communities.

By Leslie Shaver • Nov. 19, 2025 -

7 notable multifamily transactions this fall

Investors bought properties in Atlanta, Seattle and the Sun Belt, as sales volume rose in the third quarter of 2025.

By Leslie Shaver • Nov. 19, 2025 -

Lincoln buys student housing provider Capstone

Capstone will join the Lincoln platform, strengthening its position in higher education infrastructure and enhancing its capabilities in the development, financing and operation of on-campus housing.

By Leslie Shaver • Nov. 18, 2025 -

Elme separates from its chief information officer amid downsizing

The announcement comes on the heels of the REIT’s closing on the $1.6 billion sale of 19 properties to Cortland Partners.

By Leslie Shaver • Nov. 18, 2025 -

Fannie Mae, Freddie Mac likely to hit lending caps in 2025: multifamily leaders

As a potential IPO looms, the agencies are leaning into innovation-creating structures, according to Sharon Karaffa from Newmark’s Multifamily Capital Markets Division.

By Leslie Shaver • Nov. 17, 2025 -

Highsmith, Carol M. (2011). "Robert C. Weaver Federal Building, headquarters of HUD, the U.S. Department of Housing and Urban Development, Washington, D.C" [Photograph]. Retrieved from Wikimedia Commons.

Highsmith, Carol M. (2011). "Robert C. Weaver Federal Building, headquarters of HUD, the U.S. Department of Housing and Urban Development, Washington, D.C" [Photograph]. Retrieved from Wikimedia Commons.

HUD is back online — and is making cuts to its homelessness program

Housing and rental assistance programs are returning after the federal government shutdown, but funding for permanent housing is getting the ax.

By Ryan Kushner • Nov. 14, 2025 -

Rents continue to slip in October

Economic uncertainty is cracking consumer confidence and multifamily operators are responding with concessions, according to a new Yardi Matrix report.

By Julie Strupp • Nov. 14, 2025 -

REITs cite economic uncertainty, supply in Q3 earnings reports

High unemployment and inflation weighed on major multifamily landlords’ results, while AI startup-related demand and coastal back-to-the-office pushes were bright spots.

By Julie Strupp • Nov. 13, 2025 -

Aimco’s board votes to liquidate the company

In 2026 the REIT’s shareholders will finalize a plan that would call for the sale of its 2,524 units, development projects and various land holdings.

By Leslie Shaver • Nov. 13, 2025 -

Landmark Properties, Abu Dhabi Investment Authority sell 8 properties worth over $1B

The joint venture sold the assets, which have 6,200 beds, to a partnership between Morgan Stanley Investment Management and Global Student Accommodation.

By Leslie Shaver • Nov. 12, 2025 -

Centerspace mulls sale, merger

The Minneapolis-based REIT’s board will consider a range of business combinations.

By Leslie Shaver • Nov. 12, 2025 -

Stockdale Capital Partners buys 2 properties in 30 days

The Los Angeles-based commercial real estate investor is looking for more opportunities after acquiring The Quincy at Kierland in Arizona and a class A property in Dallas last month.

By Leslie Shaver • Nov. 6, 2025 -

Matt Ferrari leaves TruAmerica to start new apartment firm

Funds from multifamily newcomer BroadVail Capital Partners will capitalize the AVB and Archstone alum’s new venture, which will be called PXV Multifamily.

By Leslie Shaver • Nov. 5, 2025